Monetization Law Number #24

Outcome based risk alignment can result in asymmetric monetization

All profit is derived from risk - Peter Drucker. The bigger the risk, the greater the potential reward.

Risk alignment is the biggest driver of reward.

This chapter explains how risk alignment drives your monetization growth.

The Rule provides a quick monetization heuristic i.e. a rule of thumb in operation, a kind of —do this— and you’ll be 80% of the way there.

Rationale explains why the rule works with deeper insights and its use in practice.

Rabbit hole provides more in-depth resources and recommendations for anyone wanting to spend more hours researching each topic.

⓵ Rule 📖

⓶ Rationale 🧠

⓷ Rabbit Hole 🐇

⓵ Rule: Monetization Law #24 📖

Risk alignment can supercharge your monetization.

⓶ Rationale: Monetization Law #24 🧠

The foundations

The progress of many civilizations was built on the concept of risk delivering reward.

In ancient times, the expensive and risky business of war was the tool of choice to garner asymmetric returns.

This, in turn, spurred the financing and insurance of ships, and so on.

The risk was present in many forms; financial, reputational and, even that of life itself.

Risk alignment today

Peter Drucker asserted ‘all profit is derived from risk’ - and that risk is not to be avoided, but managed and optimised.

The financial markets provide a very active example of risk aligned outcomes - albeit somewhat asymmetric.

Hedge funds and Venture Capital funds are often set up charging a small % admin/management fee [0.1-2%] with a 10%-20% share of any upside.

This so-called ‘skin in the game’ model is not for the faint-hearted, but the upside potential is obvious.

Risk alignment tomorrow

Therefore, the question is, how much risk are you willing to take on for an increased return?

While not relevant for all industries, healthcare, medicine, etc., risk acceptance is viable for most others, particularly in the consulting, marketing, and coaching fields where benchmarks and metrics can be agreed upon and tracked.

This approach to pricing will, at the very least, allow you to understand the client/customers desired state outcome and assess your confidence in the ability to deliver the required results.

Risk alignment in design - what’s the price of a design?

The financial markets offer several active risk alignment scenarios, as explained above. However, the business of design delivers less straightforward yet more exciting examples of unlimited asymmetry.

Imagine it’s 1971, you’re a creative designer in Portland, Oregon asked to design a simple logo for a running shoe.

Your average price is $35 [$250 in today’s money].

The startup founder, short of funds, instead offers you 0.1% of his new running shoe company.

What should you do?

You probably recognize the shoe company by now.

Nike.

$35 was the fair market price paid by Phil Knight in 1971 [a price which would be accepted even in today’s market with the likes of Upwork and Fiverr].

That 0.1% would now be worth $150m.

But there’s a happier story…

David Choe was offered $60k or company stock for a large mural in 2005. He chose equity.

His shares in Facebook were worth $200m at IPO! And much much more right now if he held onto them!

Risk alignment: a case study

The mental shortcut - that risk should be proportional to reward - infers that reward size derives from risk.

But what does this mean for a company looking to set a price?

If we assume that value capture of 1-10% of customer’s increased value is reasonable, the game reverts to how we estimate the increase in customer value.

Here, the example of one of the most hotly contested software markets - Email Marketing Software - of the last 20 years offers us a chance to glimpse value capture as a mathematical construct.

From previous laws, we have asserted that value pricing trumps cost pricing.

So what’s the value metric for e-mail marketing customer value?

Let’s examine the potential list of key e-mail marketing metrics from first principles and interject the concept of risk alongside the analysis.

Assuming that the goal of maintaining an e-mail list is to have direct access to sell a product, we can surmise the following key-value metrics:

No. of Contacts | E-mail Deliverability% | No. of Emails Sent | Open % | Sales Conversion % | Total $ Sales.

Working chronologically, we can assume that–the least risky value metric [for the email marketing provider] is No. of contacts and the riskiest, the Total $ Sales

An industry example would look like this:

–No. of Contacts = 10,000

–E-mail Deliverability% [i.e. emails not marked as spam] = 80%

–No. of Emails sent per month = 2 x 10,000 = 20,000

–Open % [the % of emails which are opened] = 20% [industry standard average]

–Sales Conversion % [the % of sales per mails opened] = 5% [a reasonable performance]

–Sales Price = $29 [let us assume an instructional e-book which is a fairly standard product]

Total $ Sales [sales price x conversion] = $4,640

[[[ Math: [20,000 x 80% x 20% x 5% x $29] = $4,640 ]]]

At $99 per month, this represents a value capture of [99/4,640] = 2.1%

This is above the baseline 1% emotional threshold but still may be leaving money on the table! And no one likes leaving money on the table!!

However, the intense competition [ i.e. 30 or so well known providers duking it out] amongst the email provider landscape offers some explanation of the reasons why value capture may continue to trend downwards in this field.

⓷ Rabbit Hole: Monetization Law #24 🐇

Ding ding; round ten

Having analyzed the current value capture of the e-mail marketing software industry, how could this be improved?

Let us first briefly re-cap the competitive landscape that faces the industry, and its implications for monetization.

Currently, over 30 companies are in direct competition, with MailChimp being one of the early market pioneers that remain near the top of the pack.

However, this furious feature-fest of rivalry masks the real threats to the industry's future monetization.

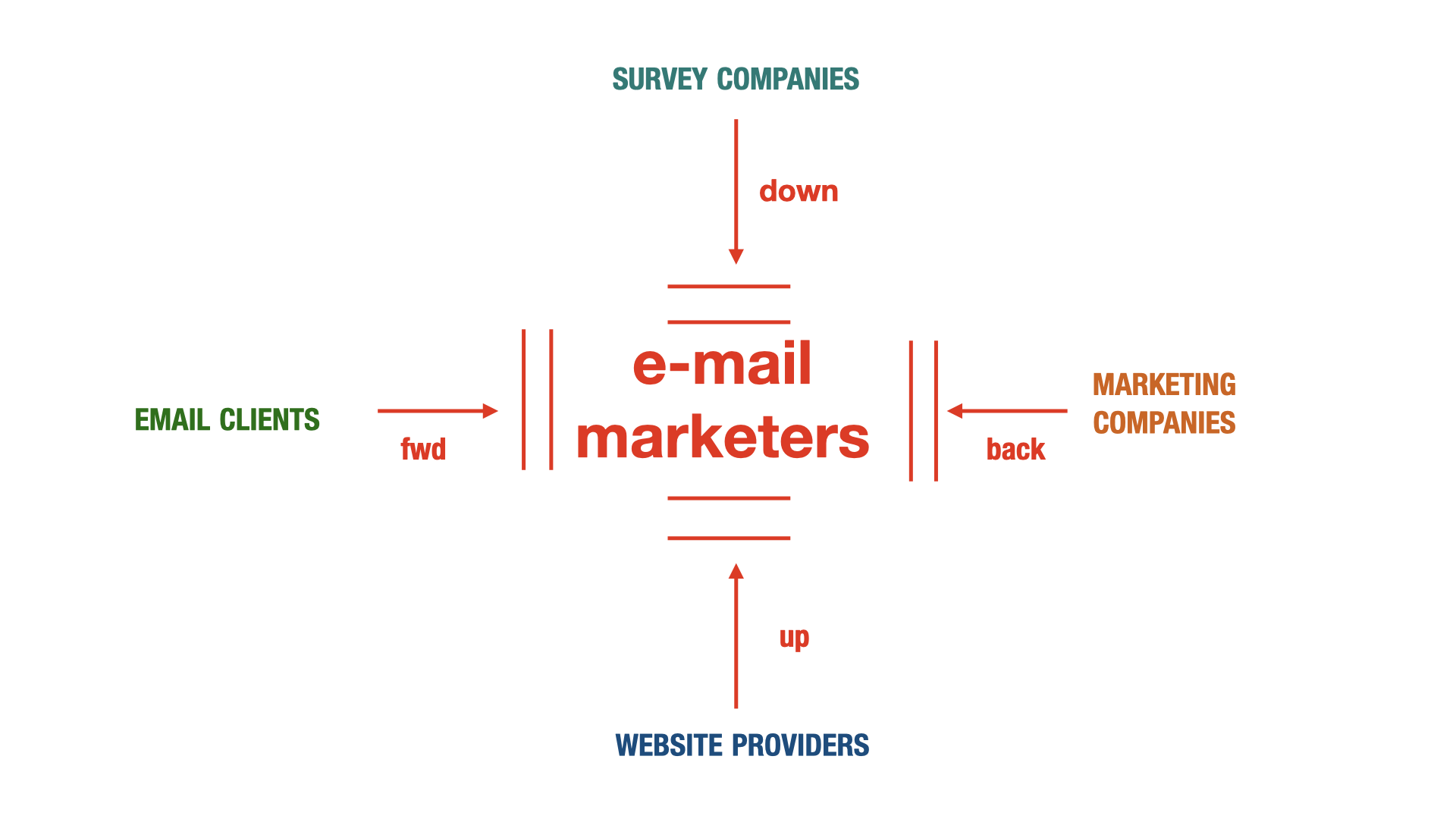

The diagram below offers an overview of where the real monetization threats could arise in the future.

The desired end goal of the customer is to convert. So the real job to be done for email providers is to drive action from the recipient.

This may convert prospects to sales, signs up to attend conferences, or take any number of affirmative actions.

In simple terms, they want to reach and then convince.

Each of the four key external threats has some history, skill, and skin in this simplified game.

E-mail clients like google Gmail could help improve deliverability - a key factor in the success of e-mail marketing.

Survey companies such as survey monkey have DNA in the gamified engagement of audiences. Increased engagement leads to increased opens or conversions.

Marketing companies such as Hubspot have already sought to bundle e-mail marketing into their vibrant mix of existing services minimizing their clients' need to integrate across platforms.

Website providers such as Squarespace are encroaching too. Given the collection of e-mail contacts that may well happen on the said website, the offer of Client Relationship Management [CRM] tools plus e-mail marketing seems natural, right?

We’ve seen the threats, but what are the existing monetization opportunities?

Well, this is where we look to risk alignment for the answers.

Moving along the risk curve will lead to more risk, but a higher potential reward.

Taking each in turn:

–Improving e-mail deliverability - an increase in deliverability from 80% to 81% [[$4,698-$4,640]] leads to a $58 revenue uplift for clients.

–Industry open rates in the 15-25% also indicate a wealth of upside potential in improving open rates.

This could be done by artificial intelligence that focuses on the best days and times to send and headline creation and psychographic segmentation tools.

A small increase in open rates from 20% to 21% would result in $232 [[$4,872-$4,640]] extra revenue for their clients.

–Sales conversion improvements offer the largest rewards.

An increase from 5% to 6% conversion leads to an extra $928 [[$5,568-$4,640]] revenue for the marketer.

The provision of copywriting services, hyper-personalization, templated sales pitches, and coaching would be welcomed by e-mail marketers looking for an edge.

The increased monetization potential for the e-mail provider ranging from $18.4 [2%x$928] to $92 [10%x$928] represents an uptick from the $99 per month of +18% or +90% at the top end of risk alignment.

Increased risk alignment to your customers leads to increased monetization rewards!

🐇 Additional Research 🐇

Any book written by Peter Drucker is highly worthy of your time, but I think his quotes best encapsulate the atoms of his thinking.

Here are a few gems for you…

–The best way to predict the future is to create it.

–There is nothing so useless as doing efficiently that which should not be done at all.

–Whenever you see a successful business, someone once made a courageous decision.

–The purpose of a business is to create a customer.

–The aim of marketing is to know and understand the customer so well the product or service fits her and sells itself.