Monetization Law Number #12

Anchoring high increases your overall monetization

Anchoring provides a priming marker in the mind of the customer that is emotionally difficult for them to dispel.

Your price is always relative, not absolute.

This chapter explains the use of psychological anchors in your monetization success.

The Rule provides a quick monetization heuristic i.e. a rule of thumb in operation, a kind of —do this— and you’ll be 80% of the way there.

Rationale explains why the rule works with deeper insights and its use in practice.

Rabbit hole provides more in-depth resources and recommendations for anyone wanting to spend more hours researching each topic.

⓵ Rule 📖

⓶ Rationale 🧠

⓷ Rabbit Hole 🐇

⓵ Rule: Monetization Law #12 📖

Your product or service is worth the value it brings to your customers. They define that value. Your monetization anchors help them understand how to frame that value.

⓶ Rationale: Monetization Law #12 🧠

What is an anchor?

Simply put, an anchor is a process of making something stay in one position by fastening it.

In ship terms, this means a heavy hunk of metal.

For pricing, this means having a price that is anchored in the customer’s mind - one which they find cognitively heavy to move, let alone dispel.

Anchoring - a tactic hiding in plain sight

The concept of anchoring is widespread, but not well known.

It is useful across all pricing and quoting arenas, but is particularly effective when done in person.

We’re all familiar with the - “I’m not gonna charge you X, I’m not even gonna charge you Y” sales tactic.

Anchoring is a more effective method of achieving the same results where the client themselves rationalise the price and quality on their terms without the need to force the issue or resort to sales hack tactics.

Anchoring example

We previously explained the benefits of only using three prices when quoting.

The anchor price would be the one that is shown first to the client.

For example, many quotes use the somewhat cliched, but effective approach of platinum, gold, silver. In addition to the numerical anchors, it adds a contextual layer by the association with precious metals.

So prices could be quoted as; $10,000 Platinum, $4,000 Gold, $1,000 Silver.

The referencing of external value anchors adds additional value to the coherence of the quote.

Most people would have a clear value distinction in their minds between platinum, gold and silver, therefore the prices merely affirm their beliefs and hence acceptance.

⓷ Rabbit Hole: Monetization Law #12 🐇

Arbitrary Coherence

The work of behavioural economics introduced the theory of arbitrary coherence.

This concept proved that although we do not know how to value something in the first place, once we have emotionally anchored a specific value or price, all other prices are viewed and ranked in reference to that anchor.

For example, most people don’t know the true cost of manufacturing a mobile phone, yet by Apple setting an anchor, all other mobiles are seen relative to that lens - either cheaper or more expensive, faster or slower.

The same was true for video recorders, digital camera and large screen televisions - relative price mattered more than absolute prices.

The anchoring index

Anchoring is a cognitive bias that influencing our decision-making abilities.

Operating under the condition of uncertainty, this bias uses our reliance on a certain piece of information to form rational evaluations of what comes after.

Typically, the first bit of information we receive becomes an anchor and all future comparisons are based on this anchored piece of information.

Daniel Kahneman explained the anchoring effect in terms of an anchoring index.

The Anchoring Index seeks to explain the cognitive estimation error that occurs between a low and high anchor.

For example, imagine you’re shopping online for exclusive designer trainers/sneakers.

The first price you see is $1,200 for the limited edition.

If you were asked to estimate the price of the next best alternative - (for simplicity sakes, say a trainer by the same designer, but not limited edition) - your estimate would be higher under the $1200 anchor than it would be with an $800 anchor.

Kahneman estimated that the anchoring index could be as high as 50%…which in our example would lead to a perception valuation difference of $200 i.e. the difference between charging $600 or $400 for the non-limited edition trainer.

The $1,200 anchor yielding an extra $200 per unit for non-limited edition.

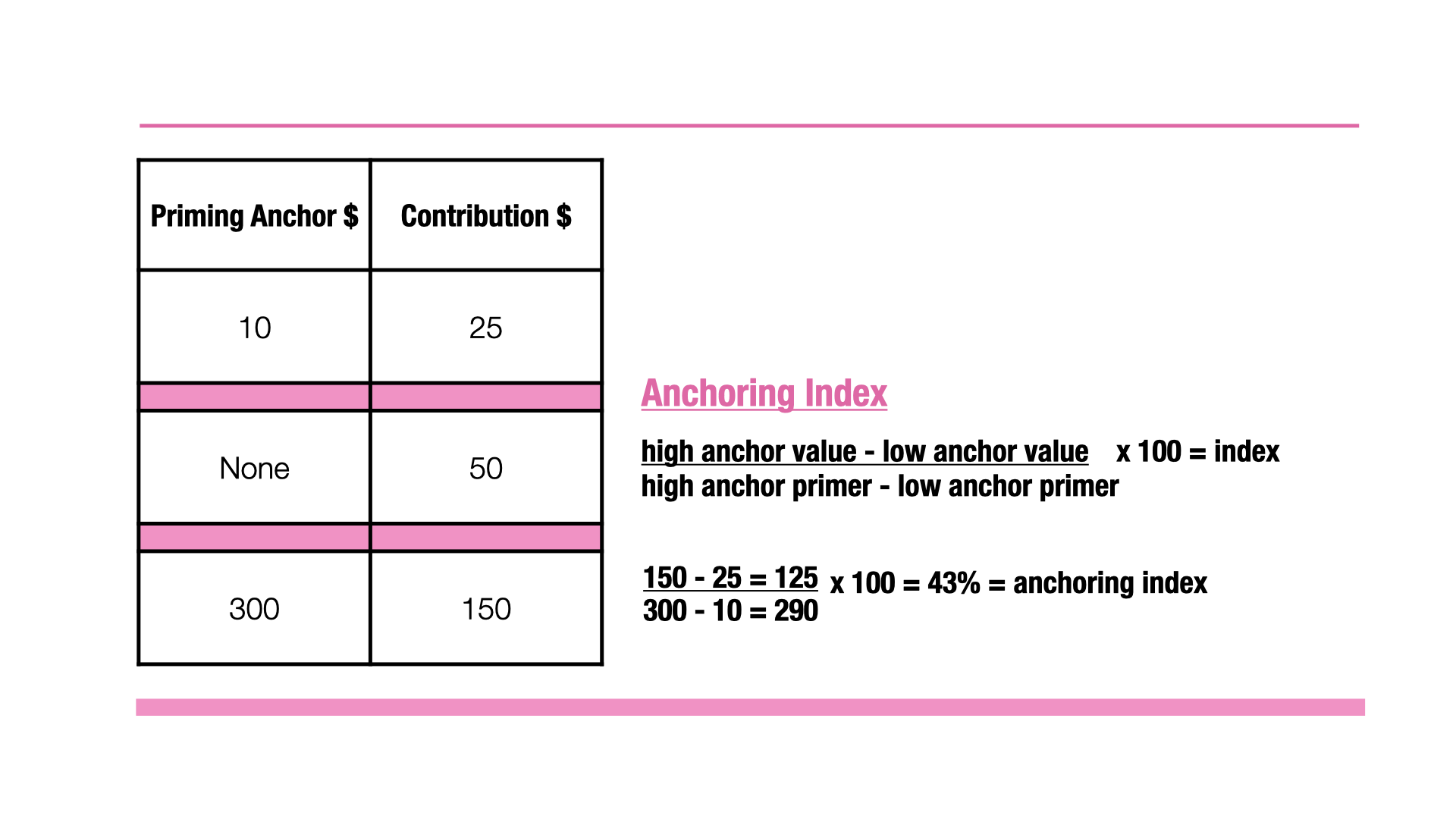

Anchoring index calculation

The anchoring index can be further explained by a more complete example.

Let us imagine a charitable concern and how the anchoring index could be calculated.

Kahneman utilised an experiment whereby contributors were shown different anchors to gauge the variance that anchoring primers created. We provide an illustrative re-creation below.

The initial primer of $10 contribution results in an average of $25 being donated.

When no primer is offered, the average offer equated to $50.

Lastly, when a $300 primer is positioned, the result is a $150 average contribution.

There is one proviso, the primer must be plausible.

The results show the effect of the plausible priming agent, the anchor - which yielded a six-fold increase in the contribution and an anchoring index of 43%.

Anchoring rocks!

🐇 Additional Research 🐇

Thinking fast and slow is the standout go-to book on the subject of anchoring and all manner of other behavioural economics that can be used in your monetization strategy.